|

The value of new mortgages slipped another 2.1 per cent in January, marking Australia's largest annual decline since the global financial crisis.

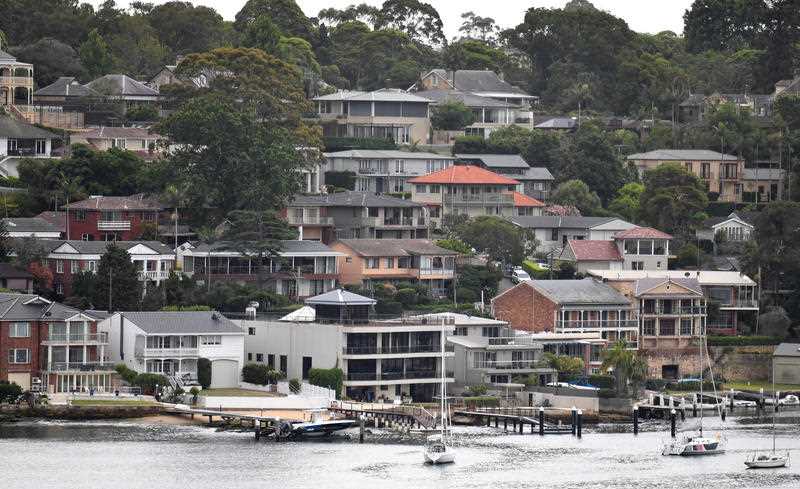

The value of dwelling commitments excluding refinancing slipped to $17.12 billion in January, according to seasonally adjusted figures released on Tuesday by the Australian Bureau of Statistics. That made for a 12-month decline of 20.6 per cent, with the total number of owner-occupier mortgage commitments falling 2.6 per cent over the month and 13.6 per cent over the year to 47,407. "The pace of declines in housing finance eased in January from the sharp declines in December, but the trend remains very weak, with a positive turn unlikely in the near term," ANZ economists Jack Chambers and David Plank said. "Further improvements in housing affordability or a significant loosening in lending standards (which is unlikely) would be the necessary precursors to an improvement in finance and the housing market overall." House prices in most capital cities have fallen - by more than 10 per cent in Sydney from their 2017 peaks - as lenders tighten the flow of credit amid regulatory intervention and the harsh light of the royal commission. "Weaker lending for dwellings again drove much of the overall fall in lending to households, with further falls in lending for investment dwellings and for owner-occupier dwellings in January," ABS chief economist Bruce Hockman said. "Reflecting the impact of both supply and demand side factors, new lending for dwellings is down over 20 per cent from January 2018, the largest through the year decline since late 2008." The biggest monthly fall in the number of owner-occupier commitments was the 9.5 per cent drop for newly built homes. In dollar terms, owner-occupier dwellings excluding refinancing fell 1.3 per cent to $12.45 billion, taking the annual decline to 17.1 per cent. New investor loans fell 4.1 per cent in January - and 28.6 per cent over 12 months - to $4.67 billion. Total household lending, which includes personal loans, fell 2.4 per cent in the month to $31.29 billion, 17.5 per cent lower than a year earlier. Lending to businesses jumped 10.8 per cent to $34.74 billion. Comments are closed.

|

Details

ArchivesCategories |

RSS Feed

RSS Feed